Should Business Owners Supervise Bookkeepers?

Should Business Owners Supervise Bookkeepers?

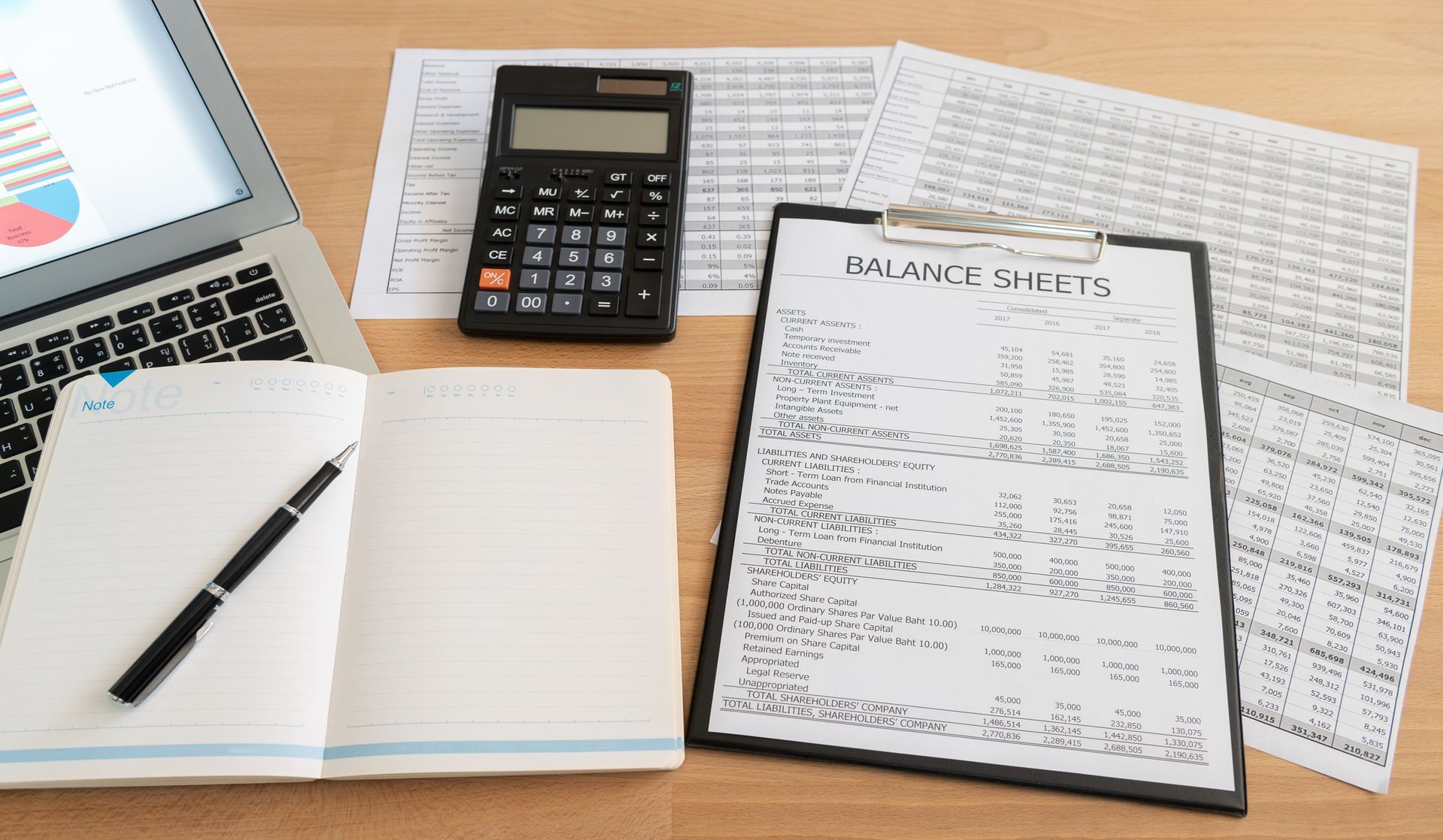

Business owners have the ultimate responsibility to ensure that their financial records are accurate, compliant, and reflective of the company's financial health. However, not all business owners have the expertise or time to effectively supervise bookkeepers, especially if they lack a background in accounting or finance.

In such cases, hiring a Certified Public Accountant (CPA) to provide oversight can be a wise decision. CPAs are trained professionals with a thorough understanding of accounting principles, financial reporting standards, and tax regulations. They also adhere to a strict code of professional conduct and ethics, which includes principles such as integrity, objectivity, competence, and confidentiality.

By engaging a CPA to oversee the work of the bookkeeper, business owners can:

Ensure Accuracy: CPAs can review the bookkeeper's work to identify errors, inconsistencies, or areas for improvement, helping to maintain the accuracy and reliability of the financial records.

Enhance Compliance: CPAs are knowledgeable about relevant laws and regulations governing financial reporting and taxation. They can ensure that the company's bookkeeping practices adhere to these requirements, reducing the risk of legal issues or penalties.

Obtain Expertise: CPAs bring a depth of knowledge and experience to the table, offering valuable insights and guidance on financial matters that may be beyond the expertise of the business owners.

Mitigate Risk: By having a CPA oversee the bookkeeping process, business owners can reduce the risk of financial mismanagement, fraud, or errors that could negatively impact the company's operations and reputation.

While business owners should ideally have a basic understanding of financial concepts and be actively involved in monitoring their company's finances, it's understandable that they may not always have the time or expertise to effectively supervise bookkeepers. In such cases, hiring a CPA to provide oversight can help ensure that the company's financial affairs are managed effectively and ethically. Plus, hiring a good CPA helps you to professionalize your organization, and enables you to scale your operation and grow your business. At Take Flight Business Solutions LLC, we provide you with a bookkeeper with CPA oversight, so that you get the best situation for your business. If you would like to learn more about how we can help you, please feel free to contact us.