Navigating the S-Corp Conversion, A Strategic Move for Sole Proprietors and Partnerships

Navigating the S-Corp Conversion: A Strategic Move for Sole Proprietors and Partnerships

Introduction:

In the dynamic landscape of small business operations, the decision to transition from a sole proprietorship or partnership to an S-Corporation (S-Corp) marks a significant strategic move. This transition is more than a procedural shift; it’s a gateway to potential tax benefits and enhanced legal protection. Understanding the nuances of an S-Corp and how it differs from other business structures is crucial for business owners contemplating this change.

What is an S-Corp?:

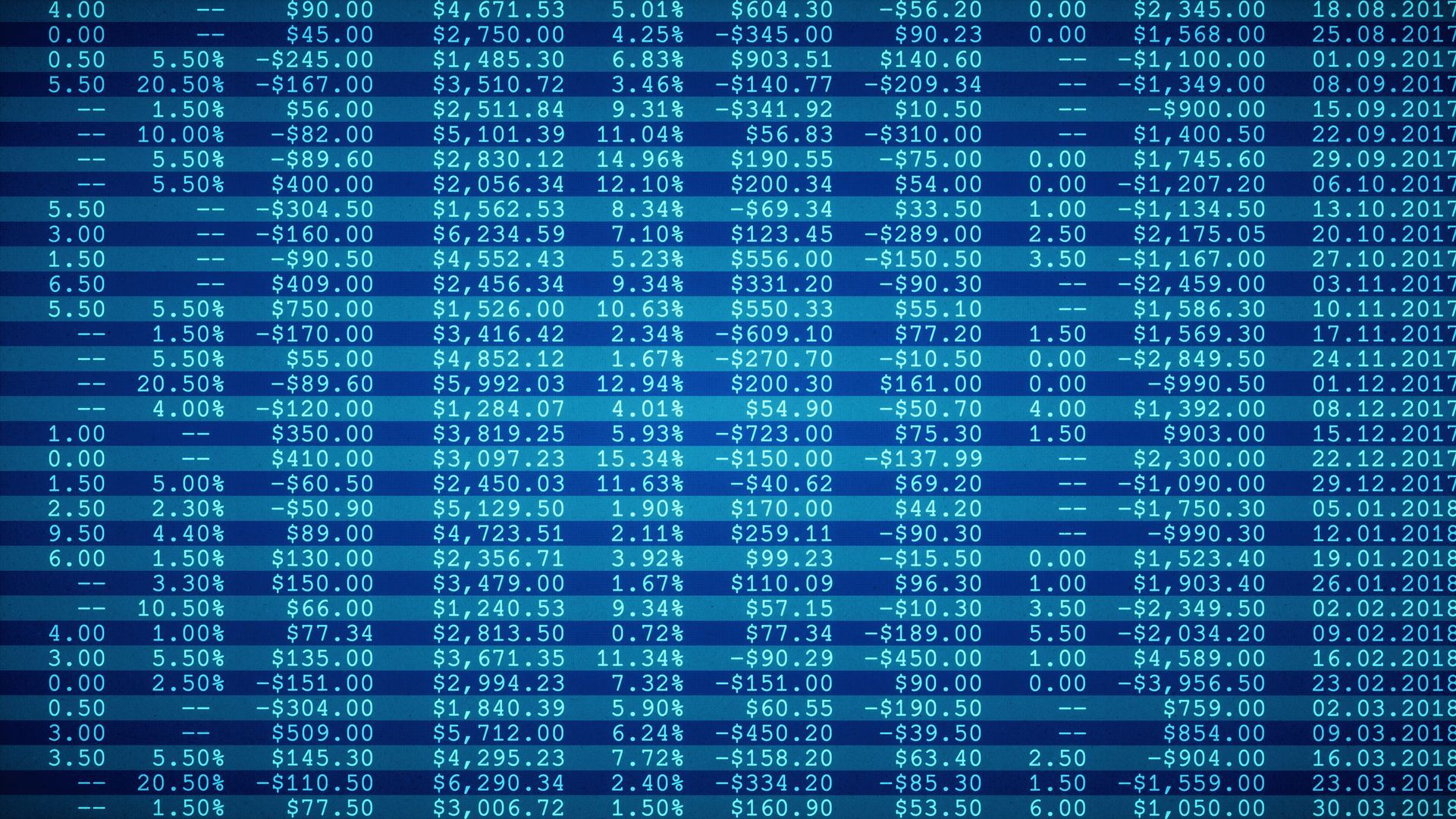

An S-Corp is a specific type of corporation that meets certain Internal Revenue Service (IRS) criteria. This designation allows profits, and some losses, to bypass traditional corporate tax rates and be passed directly to the owners' personal income. To qualify for S-Corp status, businesses must adhere to IRS requirements, including restrictions on the number of shareholders, which is capped at 100.

Benefits of Converting to an S-Corp:

Tax Advantages:

The primary allure of S-Corp status lies in its tax benefits. Unlike sole proprietorships or partnerships, where earnings are subject to personal income tax rates, an S-Corp allows owners to draw salaries as employees while also receiving dividends as shareholders. This structure can lead to substantial tax savings, particularly regarding self-employment taxes.

Limited Liability Protection:

An S-Corp provides its owners with limited liability protection, safeguarding personal assets from business debts and legal disputes. This level of protection is a significant step up from the unlimited liability inherent in sole proprietorships and partnerships.

Enhanced Credibility: Transitioning to an S-Corp can elevate a business’s market standing. This incorporation status is often perceived as a sign of stability and long-term commitment, making the business more attractive to potential investors and lenders.

Considerations Before Converting:

Eligibility Requirements: Businesses must meet specific criteria to qualify for S-Corp status, including shareholder limitations and operational guidelines. Failure to comply can result in loss of S-Corp status and its associated benefits.

Administrative Requirements:

S-Corps face more stringent administrative and record-keeping requirements than sole proprietorships or partnerships. This includes regular payroll tax filings and potentially more complex annual tax returns.

Payroll Obligations: S-Corp status mandates that owners who work in the business must receive a reasonable salary, subject to payroll taxes. This requirement adds a layer of payroll administration not present in simpler business structures.

Common Misconceptions about S-Corp Conversion:

Many business owners harbor misconceptions about S-Corps. Some believe that S-Corp conversion will erase all their tax burdens, which is not accurate. While it can reduce certain taxes, it doesn’t eliminate them. Another common myth is that the conversion process is prohibitively complex. Though it involves several steps and strict adherence to rules, with proper guidance, the process can be straightforward.

How to Convert to an S-Corp: Converting to an S-Corp involves filing Articles of Incorporation with your state and submitting Form 2553 to the IRS. This process may vary slightly depending on state laws. Engaging a tax professional or attorney is advisable to ensure compliance and a smooth transition.

Conclusion:

Deciding to convert to an S-Corp entails a thorough assessment of your business's unique situation. The tax advantages, liability protection, and enhanced business credibility can significantly benefit many small businesses. However, it’s vital to weigh these benefits against the increased administrative responsibilities. For those who find the trade-offs favorable, converting to an S-Corp can be a transformative step in their business journey.

This expanded post now provides a more detailed and comprehensive look at the implications and benefits of S-Corp conversion, suitable for small business owners considering this option.