Enhance Your Business Efficiency: Outsourcing Payroll Services in Pensacola

Enhance Your Business Efficiency: Outsourcing Payroll Services in Pensacola

Nowadays in this fast-moving business world a well running and efficient operation is vital to a successful business. One-way companies can maximize their effectiveness and efficiency is through using payroll services. Normally it is quite daunting and complex to manage an internal payroll system in a company. It requires spending much on valuable resources and time rather than concentrating on core business operations.

That is why effective and efficient payroll services are important. These services not only help businesses pay their employees and contractors on-time, but also help them comply with federal and state laws and minimize costly penalties. By using outsource payroll services in Pensacola, Gulf Breeze, Pace, or Milton, firms can make their workflows smoother, trim administrative loads and concentrate more on strategic initiatives.

In this blog we will discuss the various benefits of outsourcing payroll services, why you should outsource and how to choose the best payroll service provider.

Benefits of Outsourcing Payroll Services

Cost-effectiveness

Reduce Operational Costs: Opting for outsourcing companies saves a lot of resources and time that had to be spent on full-time employees such as wages, welfare, and training.

Prevent Expensive Mistakes: Professional payroll outsourcing services have the capacity to prevent costly errors, which means that corporations will not incur any financial penalties.

Forecast Costs:

When this service is done in-house, the cost of payroll services may fluctuate but if outsourced through a Pensacola, Gulf Breeze, Pace, or Milton payroll services provider, such costs become predictable and consistent.

Have Expert Support for Mistakes:

Let us face it. Mistakes happen. Do you want to have to deal with it or rely on an expert to help get it done? It is up to you. Mistakes that go unresolved, however, become large expensive problems. An expert focused on resolving issues would be ideal.

Timesaving

Streamline Processes: When a company outsources its payroll, its HR and finance workers have more time to concentrate on essential duties and core business activities.

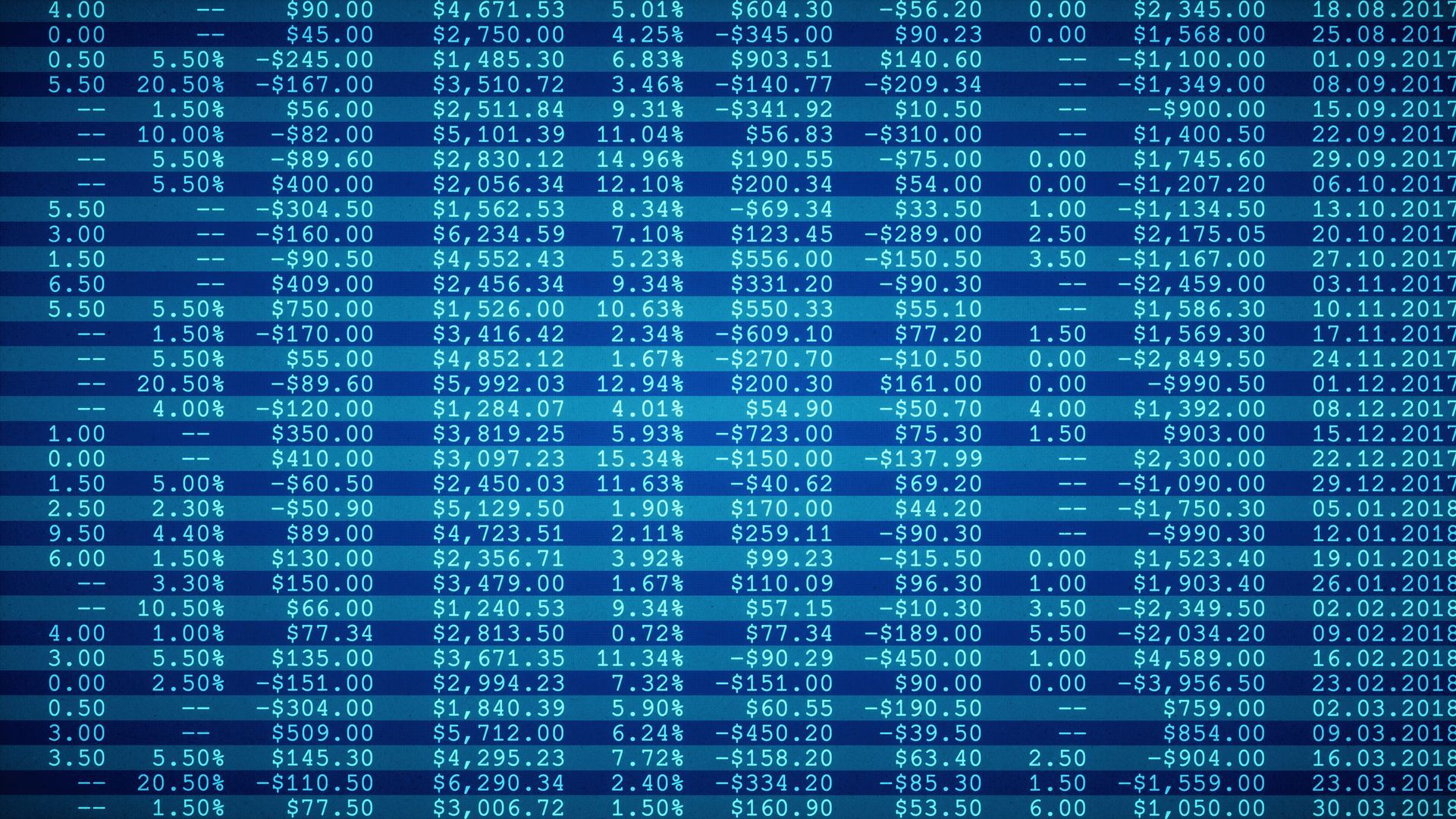

Reduced Time Spent: Payroll management companies utilize analytical methods and software to accomplish payroll quicker and more accurately thereby minimizing time spent, allowing for other tasks to be accomplished.

Growth-Oriented:

Delegating payroll responsibilities enables entrepreneurs and managers with focusing on growth and the operations of the company.

Compliance and Accuracy

Stay Updated with Regulations: Payroll services ensure that businesses stay up-to-date by keeping their clients updated about the most recent payroll laws at the federal, state, and local levels.

Precise Calculations: Skilled payroll providers employ sophisticated tools for exact calculations thereby reducing mistakes during payroll processing.

Timely Submission of Taxes: By outsourcing, every tax filing and payment is done timely and according to the deadlines set by the federal and state governments, preventing you from having to pay penalties.

Focus on Core Business Activities

Increase Productivity: By getting experts involved in payroll, outsourcing saves time and resources and enables your core staff to concentrate on more strategic projects.

Reduced Internal Administrative Burden: Outsourcing payroll streamlines your administrative processes by reducing the need for an in-house payroll department, which would typically cost more

Why Outsource Payroll in Pensacola?

Local Expertise

Regional Economic Insights: Local providers, such as in the Pensacola area, know the state and local governmental requirements for payroll services, which helps to better meet local market needs.

Personalized Service: Opting for an outsourcing service in Pensacola, Gulf Breeze, or Pace offers the opportunity for personalized interaction with better service and a number you can call..

Compliance with State Laws and Regulations

Stay Updated with Employment Laws: Experts in managing payrolls work to keep up-to-date with changing legislation and make sure that your company complies to them.

Avoid Penalties and Fines: Proficient payroll services minimize the chances of mistakes that may result in expensive fines due to failure to comply with federal and state laws.

Efficient Tax Filing: Outsourcing provides the user with expert handling of tax filings and payments. The outsourcing company could use best practices for filing and making payments.

When Deciding on a Payroll Service Provider

Choosing the correct source of payroll service is critical for the effective and accurate management of your company’s payroll when considering outsourcing. Here are some suggestions for choosing the right payroll service provider:

Reputation and Experience

When it comes to choosing a payroll service, you should start by evaluating their reputation and experience. A company’s longevity and strong history could mean it is competent in managing such intricate procedures. Check out reviews and see if you can contact any former clients for feedback about the providers.Also, see their work history in relation to your industry because this ensures they can handle your requirements.

Services Offered

When choosing a company for payroll services another important point to consider is the range of services they offer. It is not enough for payroll companies to just process employee payments. They must also file taxes, comply with federal and state laws, and provide payment options to employees and contractors.

Your business can become more efficient when you streamline many tasks through one service provider who offers advanced functions like time tracking, benefits administration or even human resource support along with this. Assess what you need considering different aspects of your company, then make sure that these needs are met by potential providers while allowing room for growth.

Pricing and Contract Terms

It is important to understand how a payroll service provider prices their services and what you are getting yourself into when you sign the contract. Different companies charge in different ways: some have flat monthly rates while others use “per employee” models or tiered systems (where more features cost more money).

Make sure that each plan is stated clearly and written so there are no surprises later down the line with additional charges for extra elements. Additionally, read all terms carefully, looking out especially for any hidden fees not mentioned upfront.

Best Outsource Payroll Services Pensacola: Take Flight Business Solutions

Looking for the most excellent outsource payroll services in the Pensacola, Gulf Breeze, Pace, or Milton areas? Visit Take Flight Solutions. We are an online business solution provider that can manage all your payroll tasks. Our services are quick and comply with all tax laws and regulations. Only give us your employee data such as hours worked by each employee, their physical address among other necessary information and we will take care of the rest for you.

Our payroll services include:

- Direct Deposit for Your Employees

- Federal Tax Liabilities

- State and Local Tax Liabilities

- Unemployment Tax Liabilities

- Quarterly Tax Forms

- Year-End Tax Forms

- Customized Payroll Reports

- Tax Deposit Services

- W-2s and 1099s

Conclusion

In conclusion, outsourcing payroll services can be very beneficial as they offer various services such as including more accurate data, improved regulatory adherence, time efficiency and saving money. By letting experts manage payroll, companies can concentrate on their main activities. Businesses can enhance their general efficiency by utilizing outsourced payroll services. If you are looking for the best payroll services in Pensacola, Gulf Breeze, Pace, or Milton, check out Take Flight Business Solutions. We offer various online accounting and financial services to businesses such as business consultation, tax filing services, and tax planning services as well. For more information check out our website.