A Story on How to Leverage Financial Statements to Better Manage a Small Business

A Story about a Small Family-Owned Business Leveraging Financial Statements to Improve Financial Performance

There was once a small family-owned business called "In-and-out Roberts” in a small town in Texas. It was a place where families and people from all walks of life came to enjoy burgers and fries. However, despite the stream of regular customers, the restaurant’s financial health was not as savory as the meals that they served.

Enter Take Flight Business Solutions LLC, an accounting firm with a reputation for helping businesses improve their financial picture. The owner of the firm, Brian, an astute accountant with a sharp eye for detail and a heart for small businesses, was hired to do the accounting and provide business advice on the business’s finances. Brian put the resources of his organization to work. The restaurant owner, Mr. Roberts, was desperate for help, and knew he needed some financial expertise.

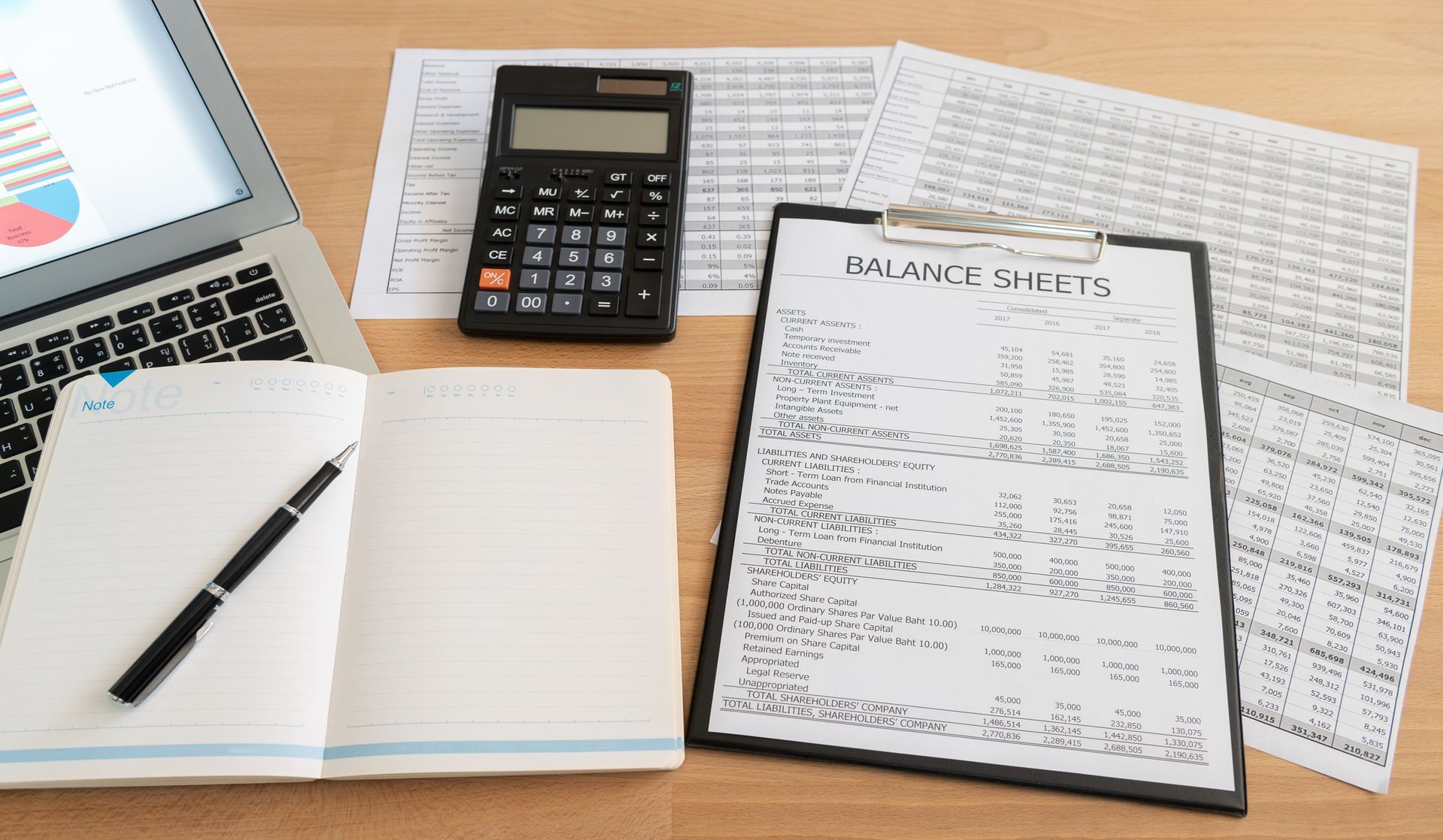

Brian and his team dived into In-and-Out Roberts’ financial statements, reviewing the line items to determine the story behind the numbers. There is always a story behind the numbers, you see. They analyzed every figure, every transaction, and every trend with meticulous care. The profit and loss statements revealed that while In-and-Out Robert’s sales were steady, the cost of goods sold, the meat, cheese, bacon, and other ingredients were rising, reducing profits over time.

The balance sheet told a story of outdated restaurant equipment while the Profit & Loss statement trends revealed that the restaurant equipment needed more frequent and expensive repairs, as the equipment got older. As Brian inquired further about the equipment, he also found out that the equipment was slowing down servicing customers and causing the business to lose customers during peak times, such as during the lunch and dinner rush.

With these insights, Brian crafted a strategy and discussed it with Mr. Roberts. After some discussion, Mr. Roberts agreed. First, they increased their prices by 10% to help cope with inflation. Second, they diversified the menu to decrease their reliance on meat by adding fish and chicken sandwiches and finding the best suppliers for these ingredients. They also looked at the cost of the new menu items to price them competitively and profitably. Next, they invested in modern cooking equipment, which, though a significant upfront cost, would save money in the long run through energy efficiency, increased cooking capacity, and lowering the cost of repairs, as the new equipment came with a 5-year manufacturer’s warranty.

The cash flow statement became their map to liquidity. They identified seasonal trends in cash inflows and outflows, and the Take Flight Business Solutions LLC team suggested measuring the return-on-investment in marketing to ensure that the marketing expense remained efficient and effective. During holidays when people ate out more, they found it quite good to invest in flyers to leave with hotels’ front desk staff and coupon mailers sent to homes within a 50-mile radius. They also established a small reserve fund to cushion against unexpected expenses.

Within 6 to 9 months, In-and-Out Roberts’ financial health was improving. With Take Flight Business Solutions LLC on the owner and company’s side, In-and-Out Roberts’ financial statements became tools for strategic decisions rather than mere reflections of the past. Mr. Roberts was now able to predict cash flow shortages and plan, accordingly, manage his debts wisely, and reinvest in his business with confidence.

The restaurant's newfound financial stability allowed Mr. Roberts to experiment with new recipes and even consider opening a second location. The community was excited, and In-and-Out Roberts restaurant prospered.

Take Flight Business Solutions LLC had not just balanced the books; they had cooked up a new future for In-and-Out Roberts restaurant business. And so, through the magic of accounting, a small business was remade to prosper, proving that with the right guidance, even the humblest financial statements could yield the recipe for success. The advice from Take Flight Business Solutions LLC team was worth over $100,000 to the business owner.

While this story is entirely fictional, it holds some truth, as it is based on some true stories. I have helped many businesses improve their business finances time and time again. Through leveraging financial statements and using my knowledge of their operations, I have been able to help owners and managers of businesses improve their financial results.